#AirIndia #SupremeCourt #Pegasus

The technology sector will lead the economic growth of the region and fintech will be at the forefront. As consumer preferences and behaviours have shifted in the wake of the COVID-19 pandemic, digital is becoming the primary way for customers to engage with their banks. This trend, combined with growing competitive pressures from more nimble start-ups, is accelerating the need for credit unions and community banks to adopt a complete, end-to-end, digital banking platform. Now the Cloud technology is reshaping the way banking services are created and delivered in our digital world. It is providing the service providers the ability to quickly adapt to market changes and make it easier for community banks and credit unions to consume new software. Financial institutions need to rethink and reimagine how you serve your customers and remain relevant in a rapidly changing, digitally-centric world. One big change that has happened and which went under appreciation is that the distinction between corporate banks and retail banks has lessened much. Between 2016 and 2019, banks were trying to come out of corporate banking. Today, the balance sheets of the top four-five banks in India show that almost all of them are 50-55% retail and 40% corporate. Therefore the balance sheets have also converged a lot and the entire distinction between corporate banking and retail banking has faded away.

We live in an era where more people have mobile phones than bank accounts or a credit history that can be reliably used to underwrite. If you look at what is happening in the world, clearly there has been a value migration from pure banking entities to some of the fintech entities whether they are in payment systems or whether they are on the internet selling part of financial products. The same thing would also happen in India. Growth of Fintech brings substantial value creation from some of the niche business models . Today,.

#AirIndia #SupremeCourt #Pegasus

The technology sector will lead the economic growth of the region and fintech will be at the forefront. As consumer preferences and behaviours have shifted in the wake of the COVID-19 pandemic, digital is becoming the primary way for customers to engage with their banks. This trend, combined with growing competitive pressures from more nimble start-ups, is accelerating the need for credit unions and community banks to adopt a complete, end-to-end, digital banking platform. Now the Cloud technology is reshaping the way banking services are created and delivered in our digital world. It is providing the service providers the ability to quickly adapt to market changes and make it easier for community banks and credit unions to consume new software. Financial institutions need to rethink and reimagine how you serve your customers and remain relevant in a rapidly changing, digitally-centric world. One big change that has happened and which went under appreciation is that the distinction between corporate banks and retail banks has lessened much. Between 2016 and 2019, banks were trying to come out of corporate banking. Today, the balance sheets of the top four-five banks in India show that almost all of them are 50-55% retail and 40% corporate. Therefore the balance sheets have also converged a lot and the entire distinction between corporate banking and retail banking has faded away.

We live in an era where more people have mobile phones than bank accounts or a credit history that can be reliably used to underwrite. If you look at what is happening in the world, clearly there has been a value migration from pure banking entities to some of the fintech entities whether they are in payment systems or whether they are on the internet selling part of financial products. The same thing would also happen in India. Growth of Fintech brings substantial value creation from some of the niche business models . Today,

Technology video | 197 views

Newer opportunities of investment | fintech companies | Digital Payments | VARINDIA News Hour

India is amongst the fastest growing Fintech markets in the world. The Indian Fintech ecosystem sees a wide range of subsegments including Payments, Lending, Wealth Technology (WealthTech), Personal Finance Management, Insurance Technology (InsurTech), Regulation Technology (RegTech) etc. India remains one of the largest markets where the structural enablers to set up and incubate fintech have come together strongly and at an apt time. Combination of steady economic growth with low penetration of financial services and availability of supporting infrastructure such as internet data access, smartphones along with utility infrastructure including Aadhaar based authentication and India Stack capabilities are likely to provide the required impetus to India's FinTech sector. The FinTech market has continued to help expand access to financial services during the pandemic, especially, the emerging market has seen strong growth in all types of digital financial services. The digital payments landscape has also grown rapidly over the last decade. India has globally positioned itself as a benchmark in digital payments owing to its resilient payment infrastructure, market practices and proliferation of digital payments across various segments which include both retail and merchants.

Fintech has helped reduce the cost of providing services, making it reachable to more people while reducing the need for face-to-face interactions, which is highly essential for keeping the economic activity during the pandemic going. As the pandemic situation is getting better, many fintechs are under stress on a number of fronts. But, as the broader economy shifts from “respond” to “recover”, new opportunities may be created for some fintechs. A key question is how fintechs may leverage their unique assets and skills to seize new opportunities in the future. It could be an opportun

Technology video | 245 views

Today our woman power has shown inner fortitude and self-confidence, has made herself self-reliant. Not only has she advanced herself but has also carried forward the country and society to newer heights : PM Shri Narendra Modi, Mann Ki Baat, 25.02.2018

Subscribe - http://bit.ly/2ofH4S4

• Facebook - http://facebook.com/BJP4India

• Twitter - http://twitter.com/BJP4India

• Google Plus - https://plus.google.com/+bjp

• Instagram - http://instagram.com/bjp4india

Watch The women have advanced themselves and carried forward the country and society to newer heights. With HD Quality

News video | 1004 views

#BJPLive #BJP

Today, the whole world is ready to join us in our Vikas Yatra. It is having unprecedented faith in India and is exuding optimism about her.

Despite global headwinds, India is standing firm and is taking her economy to newer heights.

-PM Modi

► Shorts Video ???? https://www.youtube.com/watch?v=8EoSdGriqs8&list=PL8Z1OKiWzyBHpgY--KQPQoGedordyb8ac

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

India is standing firm and is taking her economy to newer heights I PM Modi

News video | 219 views

#BJPLive #BJP

Taking Indo-France relations to newer heights!

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

► Shorts Video ???? https://www.youtube.com/watch?v=8EoSdGriqs8&list=PL8Z1OKiWzyBHpgY--KQPQoGedordyb8ac

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

Taking Indo-France relations to newer heights! #india #france

News video | 251 views

#Cabinet #Cryptotrading #Samsung

The Neo Reality

Enterprises across all industries are facing the urgent need to transform to do a newer way of business. At the same time, new technologies are set to transform the financial services market. Banks need to adapt. To stay competitive in the wide-ranging fintech landscape banks need to become more agile and embrace new technologies. Fintechs and banks are in a race to innovate and shape the future of financial services. As new technologies emerge, traditional banks will have to adapt quickly to provide their customers with what they expect, and this will lead to the emergence of new business models across the financial services sector. This accelerated momentum called ‘the Neo Reality’ is changing customer expectations. Just as with Uber and Airbnb, customers also want to dictate how and when they interact with their financial services providers, using the platform of their choice. Essentially, there are five pillars that are used to guide digital transformations at the financial institutions: “The first pillar is moving to agile. Second is moving to a more modern architecture. Third is doubling down the engineering talent at the bank, and fourth is being more efficient and transforming the technology cost structure. Finally, the fifth pillar is maniacally focusing on security and availability.”

Banking has traditionally been a monopoly with high barriers to market entry. But the relaxation of regulations in countries around the world has paved the way for neobanks to take the initiative and attract customers with the promise of lower fees, convenient mobile banking and improved customer experience that removes in-store banking. That’s why the neobank sector was valued at $30 billion+ in 2020 and is projected to grow at a Compound Annual Growth Rate of 47.7% over the next eight years. Neobanks are also attracting the unbanked customers with a combined purchasing power of $1.2 trillion. As more

Technology video | 235 views

Many of you must not be aware of the so called Superapp or Super Applications. The super-app is an omnichannel digital platform, the mobile or web application that can provide multiple services including payment and financial transaction processing, effectively becoming an all-encompassing self-contained commerce and communication online platform that embraces many aspects of personal and commercial life. Simply, it is a platform developed by a company offering various services under one umbrella. It usually involves a marketplace of third-party offerings fully integrated into the ecosystem and makes use of vast amounts of data to engage with users and offer a wide variety of experiences and services. India has already become a market where a majority of those experiencing the internet for the first time are doing so on their mobile phones. This is one of the main reasons why Indian companies are looking at building super apps. Customers can shop, book flight tickets, hotel accommodations and more using this app. The e-commerce application is expected to face stiff competition from Amazon, Flipkart and JioMart. According to a KPMG report, super-apps or conglomerated apps are having a disruptive influence on the banking and financial sector. Multiple banking apps mean that users have to manage with many login credentials and payment options, which turn out to be cumbersome.

Tata Neu super app is going to challenge Flipkart, JioMart and Amazon. Reliance Industries, under its Jio umbrella, has consolidated various services and offerings such as shopping, content streaming, groceries, payments, cloud storage services, ticket bookings etc. Further, Alibaba Group investee super-app Paytm started as an e-wallet and now offers a gamut of additional services such as mobile payments, eCommerce, insurance, movie tickets, digital gold, and so on. Flipkart Group owned payments app PhonePe has tied up with companies such as Ola Cabs, Swiggy, Grofers, AJio, Decathlon, Del

Technology video | 205 views

भारत आज विश्व के Fastest Growing FinTech Markets में से एक है।

FinTech में भारत की ताकत GIFT IFSC के विजन से जुड़ी हुई हैं, जिसके कारण ये स्थान FinTech का एक उभरता हुआ केंद्र बन रहा है।

- पीएम @narendramodi

पूरा वीडियो देखें: https://youtube.com/watch?v=cWg_uIFEy4s

► Whatsapp ????https://whatsapp.com/channel/0029Va8zDJJ7DAWqBIgZSi0K ????

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

► Shorts Video ???? https://www.youtube.com/@bjp/shorts

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

#BJPLive #BJP #PressLive #PressConference #Press

भारत आज विश्व के Fastest Growing FinTech Markets में से एक है | PM Modi | FinTech

News video | 191 views

Inauguration of Fintech Festival 2023 by Indian Banking Association President

News video | 185 views

The future of #fintech_digital_banking in India is bright. The country has a large and young population that is increasingly adopting digital financial services. In addition, the government is supportive of fintech innovation and has taken steps to create a favorable regulatory environment.

The sector has witnessed a remarkable transformation in the last few years, due to the digital revolution and supportive government policies. Fintech has not only disrupted traditional banking and financial services but also provided access to financial services to millions of underserved and unbanked individuals in the country.

Today's Headline in NewsHours

0:00 Intro

2:55 #Google Pixel 8 Phones to witness Larger Batteries and Faster Charging

3:32 ₹176 crore Tax fraud mastermind detained in B'luru

4:05 Lt Gen M U Nair named as new National Cybersecurity Coordinator

4:55 #Meta to debut 'Threads', a Twitter rival, this week

5:25 Endorsement Agreement between BYJU'S and Shah Rukh Khan in Doubt

Follow Us On :-

Website:https://varindia.com/

https://www.facebook.com/VARINDIAMagazine/

https://twitter.com/varindiamag

https://www.instagram.com/varindia/

https://www.linkedin.com/company/14636899/admin/

https://in.pinterest.com/varindia/

https://varindia.tumblr.com/

Visit on https://varindia.com/ to know more

Labels & Copyrights :- VARINDIA

Fintech Digital Banking

Technology video | 269 views

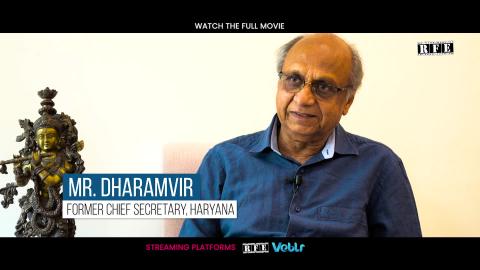

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 572603 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 108292 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 108574 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 36265 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 86735 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 58256 views

মানুহৰ জীৱনৰ ধৰ্ম আৰু কৰ্ম কিহৰ দ্বাৰা পৰিচালিত হয়?

Vlogs video | 2398 views

ভগৱান শ্ৰীকৃষ্ণৰ জীৱন দৰ্শনৰ পৰা আমি কি কি কথা শিকা উচিত?

Vlogs video | 2440 views

চুতীয়া শব্দৰ উৎপত্তি আৰু চুতীয়া সকলৰ ইতিহাস

Vlogs video | 2181 views

Neel Akash live music show 2024 Rongali Bihu || Asin Ayang mane ki? ||

Vlogs video | 2428 views