Over the past decade, the fintech sector in India has witnessed a significant rise, with investments exceeding $31 billion.

Indian fintech startups have experienced a remarkable 500% growth during this period.

- PM Modi, Mumbai, 30.08.2024

Watch the full video:

https://www.youtube.com/watch?v=tD7r9D-9iiE

► Whatsapp ????https://whatsapp.com/channel/0029Va8zDJJ7DAWqBIgZSi0K ????

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

► Shorts Video ???? https://www.youtube.com/@bjp/shorts

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

#BJP #BJPLive

Indian fintech startups have experienced a remarkable 500% growth during this period | PM Modi.

Over the past decade, the fintech sector in India has witnessed a significant rise, with investments exceeding $31 billion.

Indian fintech startups have experienced a remarkable 500% growth during this period.

- PM Modi, Mumbai, 30.08.2024

Watch the full video:

https://www.youtube.com/watch?v=tD7r9D-9iiE

► Whatsapp ????https://whatsapp.com/channel/0029Va8zDJJ7DAWqBIgZSi0K ????

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

► Shorts Video ???? https://www.youtube.com/@bjp/shorts

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

#BJP #BJPLive

Indian fintech startups have experienced a remarkable 500% growth during this period | PM Modi

News video | 178 views

भारत आज विश्व के Fastest Growing FinTech Markets में से एक है।

FinTech में भारत की ताकत GIFT IFSC के विजन से जुड़ी हुई हैं, जिसके कारण ये स्थान FinTech का एक उभरता हुआ केंद्र बन रहा है।

- पीएम @narendramodi

पूरा वीडियो देखें: https://youtube.com/watch?v=cWg_uIFEy4s

► Whatsapp ????https://whatsapp.com/channel/0029Va8zDJJ7DAWqBIgZSi0K ????

► Subscribe Now ???? https://link.bjp.org/yt ????Stay Updated! ????

► Facebook ???? http://facebook.com/BJP4India

► Twitter ???? http://twitter.com/BJP4India

► Instagram ???? http://instagram.com/bjp4india

► Linkedin ???? https://www.linkedin.com/company/bharatiya-janata-party/

► Shorts Video ???? https://www.youtube.com/@bjp/shorts

► PM Shri Narendra Modi's programs ???? https://www.youtube.com/watch?v=NQ2mG9eabWg&list=PL8Z1OKiWzyBH3ImCOpXsYZk5C-6GeKnKS

► BJP National President Shri JP Nadda's program ???? https://www.youtube.com/watch?v=mc3d67Cg3yk&list=PL8Z1OKiWzyBHWdpDfhww7RwmfMYjZYC7y

► HM Shri Amit Shah's programs ???? https://www.youtube.com/watch?v=tSX3TshTq20&list=PL8Z1OKiWzyBHIdo3uGZLPLCjb9iuYuG-2

► Popular videos ???? https://www.youtube.com/watch?v=y6mKBvuyOTg&list=UULPrwE8kVqtIUVUzKui2WVpuQ

► Playlists BJP Press ???? https://www.youtube.com/watch?v=BUUxF2zZdHI&list=PL8Z1OKiWzyBGesYbBbDcV4MtX8UUpv9Xo

#BJPLive #BJP #PressLive #PressConference #Press

भारत आज विश्व के Fastest Growing FinTech Markets में से एक है | PM Modi | FinTech

News video | 192 views

Fintech Market brings huge opportunity For Startups | Financial Technology | VARINDIA Explained

Fintech is a term used to describe the companies operating in the financial technology sector. Rising popularity for digital payments, increased investments in technology-based solutions, supportive government regulations, increased adoption of IOT devices are expected to positively influence the Global FinTech Market in the coming years. Rising innovations like mobile wallets, mobile banking, secure payment gateways, digitized money, paperless lending, etc., and adoption of e-commerce platforms across the economies, coupled with rising smartphone penetration have paved the way for increasing FinTech transactions. India has undoubtedly emerged as one of the fastest-growing FinTech hotspots in recent years. However, concerns related to data security, lack of mobile and technology expertise may hamper the FinTech market during the forecast period. Analysts say that we are still at the earliest stages of true FinTech as the future impact of cloud computing, IoT, artificial intelligence, and blockchain cannot even be estimated yet. Each year, tech companies are digging deeper into the financial services value chain and also creating new market structures in underbanked developing countries. Pure FinTech players are now sharing the market with some banks which provide new, digital-friendly banking services and integrate digital payments, microfinancing, and robo-advisor services into existing bank accounts.

Digital banking will play a crucial role in the growth of the global fintech market in the coming years. With the global adoption rate of nearly 25%, this market brings various opportunities for fintech companies. Apart from the credit financing, there are several ways the SMEs can be benefited, like using APIs and distributed accounting technologies to achieve process efficiency. According to a report from Boston Consulting Group and FICCI, India is well-

Technology video | 224 views

#crypto #blockchain #startup

Crypto Vs Blockchain Startup

There are many Indian companies working actively in the crypto space. India's crypto industry attracts foreign funds, but local investors remain wary. Cryptocurrency has seen tremendous growth in the last one year and from a consumer and technology standpoint, India is an important destination for cryptos. The venture capital companies including Sequoia Capital India, Lightspeed India, Elevation Capital and others are warming up to India’s cryptocurrency and blockchain industry. Several international funds such as Pantera Capital and Coinbase Ventures, and entrepreneur investors like Mark Cuban, have been investing in blockchain and crypto startups founded by Indians.

The absence of regulatory approval and the possibility of a blanket ban has, however, kept most Indian funds at bay, despite the heightened interest in crypto and blockchain. Despite the regulatory uncertainty and the volatility of cryptocurrencies, Indian start-ups in the space saw funding grow 73% in the first six months of calendar 2021 compared to the whole of 2020.Total funding year-to-date in 2021 stood at $50.03 million against the $28.85 million raised by cryptocurrency-based start-ups in 2020, according to data from Tracxn. A report says, the lockdown in 2020 had led to increased activity in the cryptocurrency market as retail and institutional investors turned to this investment avenue as volatility hit the stock market. Blockchain faces hurdles, including volatility in cryptocurrency pricing and confusion and misunderstanding from many consumers about the technology and related financial services, experts say.

Follow Us On :-

https://www.facebook.com/VARINDIAMagazine/

https://twitter.com/varindiamag

https://www.instagram.com/varindia/

https://www.linkedin.com/company/14636899/admin/

https://in.pinterest.com/varindia/?

http

Technology video | 248 views

Period of Fiscal Year:

The fiscal year variant contains the number of posting periods in the fiscal year and the number of special periods. In this video tutorial, we will explain Creation of Fiscal Period and Posting Periods.

Email Us: support@bisptrainings.com, support@bispsolutions.com

For Consulting: wwww.bispsolutions.com

For Trainings:https://www.bisptrainings.com/search-course

Training for SAP HANA: https://www.bisptrainings.com/courses/SAP-HANA

Registe for SAP HANA: https://www.bisptrainings.com/course-registration/sap-hana

Training for SAP FICO: https://www.bisptrainings.com/courses/SAP-FICO

Register for SAP FICO: https://www.bisptrainings.com/course-registration/sap-fico

Register here for more details: https://www.bisptrainings.com/course-registration/sap-basis

Call us: +91 7694095404 or+1 678-701-4914

Please don’t forget to Like, Share & Subscribe

Follow us on Facebook: https://www.facebook.com/bisptrainings/

Follow us on Twitter: https://twitter.com/bisptrainings

Follow us on LinkedIn: https://www.linkedin.com/company/13367555/admin/

Creation of Fiscal Period and Posting Periods | Period of Fiscal Year | Calendar Year in SAP

Education video | 412 views

Repeating Time Period in Oracle Fusion | How To Create Repeating Period | Oracle HCM Time and Labor

???? BISP Solutions Inc. was founded in 2012 as an IT consulting and service provider, specializing in Oracle EPM, NetSuite, Fusion, SAP, and BI technologies.

Immediately Available consultants on Multiple technologies

BISP Solutions Inc. List of our consultants available for C2C requirements:

For more details click on the link: https://lnkd.in/d6rRfhkR

For Consulting: https://www.bispsolutions.com/oracle-fusion-consulting-services/

Register here: https://bispsolutions.com/contact-us/

--------------------------------------------

???? BISP Trainings is the most trusted and branded name in online education across the globe. BISP is known for its high-quality education services.

For Training Schedule: https://www.bisptrainings.com/training-schedule

For Trainings: https://www.bisptrainings.com/courses/oracle-fusion

For Register : https://www.bisptrainings.com/course-registration/oracle-fusion-absence-management

???? For more info, call us: Call us: +91 7694095404 or+1 678-701-4914

► Subscribe: https://www.youtube.com/channel/UCtec03dySLsQx3ze2HZBC6Q?sub_confirmation=1

► Facebook: https://www.facebook.com/bisptrainings/

► LinkedIn: https://www.linkedin.com/company/13367555/admin/

► Youtube: https://www.youtube.com/@AmitSharma_bispsolutions/featured

► Website: https://bispsolutions.com/ and https://www.bisptrainings.com/

-------------------------------------| Thanks |--------------------------

#OracleHCMTimeandLabor #OracleTimeandLabor #oracletimeandlaborprocessflow

Repeating Time Period in Oracle Fusion | How To Create Repeating Period | Oracle HCM Time and Labor

Education video | 323 views

The term 'Funding Winter' refers to a period in which funding for start-ups becomes more difficult to obtain due to a variety of factors, including economic conditions, market trends, and investor sentiment.

Funding Winter has brought a significant impact on the growth and development of start-ups, particularly those in emerging markets like India. We are witnessing – employee layoffs, investors delaying capital infusion decisions, lower spends by start-ups in marketing, some start-ups getting valued lower than their previous funding rounds, etc. – resulting in drying up of capital flows or “Funding Winter”.

This has been a global phenomenon throughout 2022 and is expected to have an extended run in 2023 as well. Prior to funding winter, globally many startups were able to raise funds at increasingly higher valuations with relative ease. India being the third largest startup ecosystem in the world, these trends are reflected in the capital flows to Indian startups as well. A recent PwC report mentions a drop of 33% funding of Indian startups during 2022 in comparison to 2021.

Today's Headline in NewsHours

0:00 Intro

3:25 #TimCook to launch Apple's first store in India today

3:46 #Malware 'Goldoson' infects 60 mobile apps on Google Play

4:20 #Google withdraws SC appeal against NCLAT order

4:47 Jio and Bharti Airtel to provide new connections to 1.1 million employees of Indian Railways

5:25 Coca-Cola to buy minority stake in Swiggy, Zomato rival

Follow Us On :-

Website:https://varindia.com/

https://www.facebook.com/VARINDIAMagazine/

https://twitter.com/varindiamag

https://www.instagram.com/varindia/

https://www.linkedin.com/company/14636899/admin/

https://in.pinterest.com/varindia/

https://varindia.tumblr.com/

Visit on https://varindia.com/ to know more

Labels & Copyrights :-

Technology video | 229 views

New York (US): While speaking at United Nations (UN) in New York on Friday, India's permanent representative to UN, Syed Akbaruddin on the occasion of International Yoga Day said, “UN has a special place in the remarkable growth of Yoga in our own lifetimes.

Make sure you subscribe and never miss a new video: https://goo.gl/bkDSLj

For Catch Special: https://goo.gl/fKFzVQ

For Short News: https://goo.gl/hiiCJ7

For Entertainment: https://goo.gl/nWv1SM

For Sports: https://goo.gl/avVxeY

Catch is a contemporary new digital platform about the ideas and events shaping the world. It aims to filter and provide news-on-the-run for an impatient new generation. It offers greater insight for influencers and the deeper consumer of news. When opinions are shrill and polarized, we hope to create a middle ground and build bridges. When there is a set thinking, we hope to stand apart and go against the wind. The world is complex, exciting, layered, evolving, always interesting. We hope to be the same.

Lots of videos and lots more in the pipeline. Stay tuned.

Watch UN has a special place in remarkable growth of Yoga in our own lifetimes: India’s Ambassador to UN With HD Quality

News video | 297 views

#fintechindustry #pandemic #DigitalBanking Technology video | 229 views

Businesses around the world are grappling with challenging times and with the emergence of banking technologies, it has changed the face of the fintech industry. Fintech is now part of the BFSI sector and is changing rapidly, with the evolution of innovative, new-age technologies like Artificial Intelligence (AI), Machine Learning (ML), and more, digital banking is climbing to new heights. Banks are now joining forces with fintech startups to upgrade their existing systems and enable smoother operations to deliver a better experience for consumers. Banks have not only partnered with fintechs but have also been busy in modernising the lending infrastructure and the value chain which includes biometric KYC, pre-approved home loans to support digital banking.

Technological advancements seen globally are playing out in India as well. The pre-defined APIs allow banks and financial entities to club in their frequently used microservices to accelerate their business. With easy integrations and data sharing, APIs can help banks save several weeks. The demand for personal loans has only grown over the years, especially among the low-income families and borrowers, who mainly avail of these loans for consumption purposes. All fintechs popping up these days target young and low-income people who are digitally savvy and seek short-term credit solutions for pursuing various aspirations. Now fintechs are adopting a completely remote and form-less onboarding process, which is based on video, voice and images with video based KYC, fuelled by consumer demand resulting in a digital lending boom in India.

Follow Us On :-

https://www.facebook.com/VARINDIAMagazine/

https://twitter.com/varindiamag

https://www.instagram.com/varindia/

https://www.linkedin.com/company/14636899/admin/

https://in.pinterest.com/varindia/?

https://varindia.tumblr.com/?

Fintech have tailored to meet the demand of SMBs | Indian News | Business And Economy | Tech News

#FinTech #Covid19 #SMB

Fin-Tech is key enabler for SMB

As the nation recovers from the impact of the COVID-19 pandemic ,Fintech are reinventing to introduce digitally-driven business models, with this SMBs can leverage them to stay ahead of the curve. A report states, 30 percent of all small business owners reported that they’ve had to dip into their personal financial resources to support their businesses since the pandemic began. Eighteen percent of them have had to cut their full-time staff, and 15 percent have lowered their workers’ salaries. The most recent evidence of the damage caused by the pandemic. Historically, access to credit for SMBs has been limited, as entrepreneurs try to build up a credit record to access available capital. With the emergence of the FinTech era is helping to break that cycle, enabling innovation in financial services to help SMBs flourish.

The new age fintech companies well understands the changing customer preferences. The digital evolution of the connected world will be critical in commercials payments and beyond. Looking at how quickly the entire world changed during the last 12 months – with new business models, new shopping methods and new payments plays exploding on the scene – there has been an unprecedented need for agility for corporate players looking to thrive in a constantly changing market. It will be a challenging time for businesses of all sizes, but the necessary change will ultimately create a stronger playing field. “I think that in order for the economy to accelerate at this pace, it needs to break out of some of the traditional ways of thinking about commercial payments. Going forward, Embedded finance is the next wave of lending that is likely to drive expeditious adoption and democratization of fintech in India and other growing economies.

Today's Headline in New

Technology video | 188 views

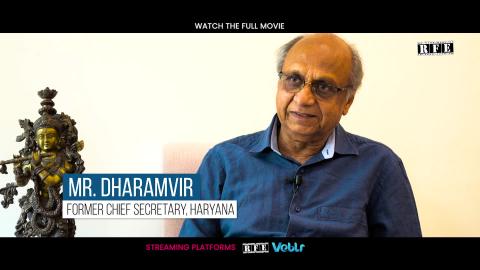

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 572673 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 108335 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 108616 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 36307 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 86777 views

SAMARPAN is an ode to the dedicated team of ASHI, Haryana and Ashiana Children's Home, as they mark their Golden Jubilee this year in 2019. Available in Hindi and English Subtitles.

Watch the full film 'SAMARPAN' online on

- Rolling Frames Entertainment - (https://rfetv.in)

- VEBLR - (https://veblr.com/)

- ASHI, Haryana's website - https://ashi-haryana.org/

About ASHI, Haryana:

Association for Social Health in India (ASHI) is a Voluntary and Social Organization aiming at challenging those conditions that lead to exploitation of women and children for anti-social purposes by providing shelter for Destitute & Orphan children and arranging for their education, vocational training and rehabilitation are one of the Association’s main activities. The Governor of Haryana, their Chief Patron, visits the Home once a year to encourage and bless the children.

All Rights Reserved - Pinaka Mediaworks LLP - 2019

Produced by: Association of Social Health in India (Haryana State Branch), Pinaka Mediaworks & Rolling Frames Entertainment.

Director: Ojaswwee Sharma

Production House - Pinaka Mediaworks LLP

- Associate Director: Rohit Kumar

- Editor: Bhasker Pandey

- Cinematography Team:

Raman Kumar

Harjas Singh Marwah

Surinder Singh

- Subtitles: Diveeja Sharma

For Pinaka Mediaworks LLP (India)

- Co-founder & CFO: Sunil Sharma

- Brand Communication Head: Diveeja Sharma

- Head of Post Production: Bhasker Pandey

- Legal Advisor: Vishal Taneja

Kids video | 58297 views