The latest release of offshore financial information has revealed little illegal activity, and will lack much of the punch that previous leaks enjoyed. However, it could still have significant consequences. While little direct regulatory action is in the offing, tighter reporting and disclosure of property holdings is the most likely outcome. The world was presented with yet another major offshore data leak on 3 October, 2021, courtesy of the International Consortium of Investigative Journalists. Branded the Pandora Papers by the media, the release contains 11.9 million files from various companies hired by wealthy clients to create structures and trusts in a range of offshore centres. While the cast of affluent individuals and high-profile politicians spans the world, there is little suggestion that the leak has revealed much in the way of illegal tax evasion. As such, there will likely be little direct impact on the wealth management industry or cases for tax authorities to prosecute.

The release does highlight the ability for affluent investors to use the offshore financial system to shelter assets from scrutiny - particularly property. The OECD’s Common Reporting Standard and the US’s FATCA have largely pealed back the secrecy surrounding financial accounts and securities. However, they have done little to force disclosure of non-financial assets such as property. Almost all of the high-profile disclosures in the Pandora Papers involve property in some shape or form. Many examples noted in the media involve property held via opaque offshore companies or trusts that shelter the beneficial owners from prying eyes, as well as saving them hefty tax bills. It is this entirely legal activity that is likely to grate the sensibilities of the average citizen - even if tax authorities are less exercised over it. Indeed, GlobalData’s 2021 Global Wealth Managers Survey found that property is the third most popular asset class among high net worth (HNW) offshore inv.

The latest release of offshore financial information has revealed little illegal activity, and will lack much of the punch that previous leaks enjoyed. However, it could still have significant consequences. While little direct regulatory action is in the offing, tighter reporting and disclosure of property holdings is the most likely outcome. The world was presented with yet another major offshore data leak on 3 October, 2021, courtesy of the International Consortium of Investigative Journalists. Branded the Pandora Papers by the media, the release contains 11.9 million files from various companies hired by wealthy clients to create structures and trusts in a range of offshore centres. While the cast of affluent individuals and high-profile politicians spans the world, there is little suggestion that the leak has revealed much in the way of illegal tax evasion. As such, there will likely be little direct impact on the wealth management industry or cases for tax authorities to prosecute.

The release does highlight the ability for affluent investors to use the offshore financial system to shelter assets from scrutiny - particularly property. The OECD’s Common Reporting Standard and the US’s FATCA have largely pealed back the secrecy surrounding financial accounts and securities. However, they have done little to force disclosure of non-financial assets such as property. Almost all of the high-profile disclosures in the Pandora Papers involve property in some shape or form. Many examples noted in the media involve property held via opaque offshore companies or trusts that shelter the beneficial owners from prying eyes, as well as saving them hefty tax bills. It is this entirely legal activity that is likely to grate the sensibilities of the average citizen - even if tax authorities are less exercised over it. Indeed, GlobalData’s 2021 Global Wealth Managers Survey found that property is the third most popular asset class among high net worth (HNW) offshore inv

Technology video | 189 views

Pandora's box is an artifact in Greek mythology connected with the myth of Pandora in Hesiod's Works and Days. The recent leakage of Pandora Papers brings newer light on the hidden dealings of the elite and corrupt. The total assets in question collectively would run into trillions of dollars. This is not the first leak, it is the third starting from Panama Papers to Paradise Papers and now Pandora Papers. It shows to the world what investigative journalism can deliver and that too when it is in a global collaborative mode. It is a leak of almost 12 million documents, files, emails and spreadsheets. This whole exercise has helped to expose the secret wealth and wheeling dealing they get into. It was a pure data based investigation, quite contrary to what we find in this country. The data was obtained by the International Consortium of Investigative Journalists in Washington DC and has led to one of the biggest ever global investigations. ICIJ is an US based not for profit, encompasses 280 of the best investigative reporters from more than 100 countries and territories. ICIJ wants to inspire and cultivate a global community of reporters and readers who believe journalism can bring about positive change.

The documents have been sourced from 14 financial services companies spreading across various countries including Panama, Switzerland and United Arab Emirates. The 2.9 terabyte leak is larger than the Panama Papers at 2.6 terabytes. The Pandora Papers leak is touted as the most expansive expose of financial secrecy. There are a cluster of 35 world leaders including current and former Presidents, Prime Ministers and heads of state. It also has within its fold 100 billionaires, celebrities and business leaders. It also has 400 public officials from 100 countries. There are well recognised companies which provide these services globally. The nitty gritty of the complex financial system with special expertise in offshore accounts, tax havens, shel

Technology video | 162 views

Hiranandani Group's Founder Niranjan Hiranandani and key members of his family were beneficiaries of a trust with assets of over $60 million, the Pandora Papers leak showed. Records of Trident Trust Company revealed that Darshan set up at least 25 companies as a director and The Solitaire Trust as the settlor in the BVI between 2006 and 2008

Pandora Papers says, Hiranandani received beneficiary of trust with $60 mn in assets

Technology video | 216 views

#ZeroTrustSecurity #PandoraPapers #Deloitte

Pandora Papers exposed Influential elites

The Pandora Papers’s 11.9 million records arrived from 14 different offshore services firms in a jumble of files and formats – even ink-on-paper – presenting a massive data-management challenge. It contains a 2.94 terabyte data trove exposes the offshore secrets of wealthy elites from more than 200 countries and territories. These are people who use tax and secrecy havens to buy property and hide assets; many avoid taxes and worse. They include more than 330 politicians and 130 Forbes billionaires, as well as celebrities, fraudsters, drug dealers, royal family members and leaders of religious groups around the world. The task involved three main elements: journalists, technology and time. The investigation is based on a leak of confidential records of 14 offshore service providers that give professional services to wealthy individuals and corporations seeking to incorporate shell companies, trusts, foundations and other entities in low- or no-tax jurisdictions.

As per Deloitte Anti-Money Laundering Preparedness Survey Report 2020, the amount of money laundered in one year is estimated to be between two percent and five percent of global GDP, or from $800 billion to $2 trillion annually. The paper claims how several ultra-rich used trusts as a vehicle for the sole purpose of holding their investments. In India, it is legitimate to set up a trust both in the country and outside. The trust is governed by Indian Trusts Act, which does not see trust per se as a legal entity but does recognise the trustee. It allows trustees to manage and make use of assets for the beneficiaries’ benefits. The rule also allows setting up trust in foreign jurisdiction. Many corporate, large business houses set up trusts for legit purposes and are genuine in nature. The Pandora Papers gathered information on more than 27,000 companies and 29,000 so-called ultimate benefici

Technology video | 140 views

Prez polls Scrutiny of nomination papers today News video

News video | 684 views

Reach us on social medial platforms:

Subscribe us on YouTube: https://www.youtube.com/channel/UCx6u0Lpm6diTjvxLtMEkMWA?view_as=subscriber

Like us on Facebook: https://www.facebook.com/mantavyanews

Follow us on Twitter: https://twitter.com/mantavyanews

Follow us on Instagram: https://www.instagram.com/mantavyanews

LIVE : https://www.youtube.com/watch?v=Sd2iJH83EbU

WEBSITE : https://mantavyanews.com/

Watch Amethi EC officer orders postponement of scrutiny of Rahul Gandhi’s nomination papers to 22nd April With HD Quality

News video | 270 views

Lack Of Maintenance Of 'Power Plants' Brings Linemen Under Scrutiny At CanaconaWatch Lack Of Maintenance Of 'Power Plants' Brings Linemen Under Scrutiny At Canacona With HD Quality

News video | 250 views

Watch 50 Wealthy Indians To Face Tax Scrutiny For Buying Nirav Modi Jewellery With HD Quality

50 Wealthy Indians To Face Tax Scrutiny For Buying Nirav Modi Jewellery

आयकर विभाग ने 50 से अधिक ऐसे रसूखदार लोगों (एचएनआई) के आयकर रिटर्न का फिर से आकलन करने का फैसला किया है, जिन्होंने भगोड़ा हीरा कारोबारी नीरव मोदी की कंपनियों से महंगी ज्वेलरी खरीदी है.डीएनए की एक रिपोर्ट के मुताबिक आय कर विभाग ने इससे पहले कई लोगों को तलब कर उनसे आभूषण खरीद का स्रोत पूछ चुका है. इनमें से ज्यादातर ने कहा कि उन्होंने नीरव मोदी की कंपनियों को कोई नकद भुगतान नहीं किया है.इसके बाद विभाग ने उनके आईटीआर की नए सिरे से जांच का फैसला किया है.

Follow us on:

YouTube: https://www.youtube.com/TV24NewsIndia

Twitter: https://twitter.com/TV24India

Facebook: http://www.facebook.com/TV24channel

Website : www.LiveTV24.tv

Tags

Tv24 news channel

Tv24 news

Breaking news

Live

Chandigarh

Press

viral in india

trending in india

Hindi khabar

Khabrein

News tak

News video | 1040 views

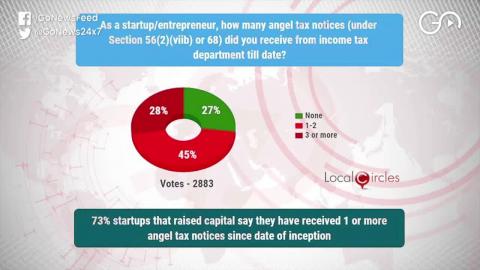

Over 2,000 Indian startups which received 'angel financing' and other funding are under income-tax scrutiny

News video | 1462 views

Tax dept to promote faceless scrutiny. It will reduce tax harassment from Vijay Dashmi day, says Finance Minister Nirmala Sitharaman.

► Subscribe to The Economic Times for latest video updates. It's free! - http://www.youtube.com/TheEconomicTimes?sub_confirmation=1

► More Videos @ ETTV - http://economictimes.indiatimes.com/TV

► http://EconomicTimes.com

► For business news on the go, download ET app:

https://etapp.onelink.me/tOvY/EconomicTimesApp

Follow ET on:

► Facebook - https://www.facebook.com/EconomicTimes

► Twitter - http://www.twitter.com/economictimes

► LinkedIn - http://www.linkedin.com/company/economictimes

► Instagram - https://www.instagram.com/the_economic_times

► Flipboard - https://flipboard.com/@economictimes

The Economic Times | A Times Internet Limited product

Watch I-T dept to promote faceless scrutiny to reduce tax harassment: Nirmala Sitharaman With HD Quality

News video | 1497 views

Subscribe to my Vlog Channel - Nidhi Katiyar Vlogs

https://www.youtube.com/channel/UCVgQXr1OwlxEKKhVPCTYlKg

-----------------------------------------------------------------------------------------------------------------------------

My Referal Codes -

Plum Goodness -

Use code - NK15 for 15% off

https://plumgoodness.com/discount/NK15

Re'equil - Use Code - NIDHIKATIYAR FOR 10%OFF

https://bit.ly/3ofrJhl

Mamaearth - Use Code nidhi2021 for 20% off

colorbar cosmetics - CBAFNIDHIKA20

Watch My other Vlogs -

https://www.youtube.com/watch?v=ih_bKToLC3g&list=PLswt2K44s-hbKsvEBLEC5fHDkEp7Wwnpd

Watch My Disney Princess to Indian Wedding Series here - Its fun to watch Indian Avatar of Disney Princesses -

https://www.youtube.com/watch?v=lPkRbupcUB0&list=PLswt2K44s-haUOABjzzUOG2jwUh_Fpr96

Watch My Monotone Makeup Looks Here -

https://www.youtube.com/watch?v=WrpPx-_F1Yw&list=PLswt2K44s-hZOfXt-sSQlVe7C_vBOjsWQ

Love Affordable Makeup - Checkout What's new in Affordable -

https://www.youtube.com/watch?v=lowjaZ9kZcs&list=PLswt2K44s-hZcQ-tZUr7GzH0ymkV18U8o

Here is my Get UNREADY With Me -

https://www.youtube.com/watch?v=aLtDX9l8ovo&list=PLswt2K44s-hbLjRz8rtj8FTC-3tZ55yzY

-----------------------------------------------------------------------------------------------------------------------------------

Follow me on all my social media's below:

email :team.nidhivlogs@gmail.com

Facebook: https://www.facebook.com/prettysimplenk/

Twitter : https://twitter.com/nidhikatiyar167

Instagram - https://www.instagram.com/nidhi.167/

Shop affordable Makeup here -

https://www.cuffsnlashes.com

------------------------------------------------------------------------------------------------------------------------------

Shop affordable Makeup here -

https://www.cuffsnlashes.com

Subscribe to my other channel 'Cuffs

Beauty Tips video | 16458 views

Styling Pakistani suit from @Meesho #shorts #meeshosuithaul #pakistanisuits #meeshokurti

Beauty Tips video | 2568 views

Barbie makeup- cut crease eye look - pink makeup for beginners #shorts #cutcrease #pinkeyelook Flat 25% off on Cuffs n Lashes entire range + free gift on all orders above 299

Cuffs n Lashes X Shystyles eyeshadow Palette - Seductress https://www.purplle.com/product/cuffs-n-lashes-x-shystyles-the-shystyles-palette-12-color-mini-palette-seductress

Cuffs n Lashes Eyelashes - Pink City - https://www.purplle.com/product/cuffs-n-lashes-5d-eyelashes-17-pink-city

Cuffs n Lashes Cover Pot - Nude - https://www.purplle.com/product/cuffs-n-lashes-cover-pots-nude

Cuffs n Lashes F021 Fat top brush - https://www.purplle.com/product/cuff-n-lashes-makeup-brushes-f-021-flat-top-kabuki-brush

Cuffs n Lashes x Shsytyeles Brush - https://www.purplle.com/product/cuffs-n-lashes-x-shystyles-makeup-brush-cs01-flat-shader-brush

Cuffs n Lashes Flat shader Brush E004 - https://www.purplle.com/product/cuff-n-lashes-makeup-brushes-e004-big-lat-brush

Barbie makeup- cut crease eye look - pink makeup for beginners #shorts #cutcrease #pinkeyelook

Beauty Tips video | 2726 views

Latte Makeup but with Indian touch #shorts #lattemakeup #viralmakeuphacks #viralmakeuptrends #makeup

Beauty Tips video | 2252 views

No Makeup vs No Makeup Makeup look #shorts #nomakeupmakeup #nofilter #naturalmakeup #everydaymakeup

Beauty Tips video | 2695 views

The Purplle I Heart Beauty Sale goes live on the 2nd of August!

BUY 1 GET 1 FREE on all mCaffeine products.

mCaffeine Cherry Affair - Coffee Face Mist - https://mlpl.link/INFIwj2Q

mCaffeine On The Go Coffee Body Stick - https://mlpl.link/INF3lvBa

Download the Purplle app here:

https://mlpl.link/JCCZ2INF

Subscribe to my Vlog Channel - Nidhi Katiyar Vlogs

https://www.youtube.com/channel/UCVgQXr1OwlxEKKhVPCTYlKg

-----------------------------------------------------------------------------------------------------------------------------

Watch My other Vlogs -

https://www.youtube.com/watch?v=ih_bKToLC3g&list=PLswt2K44s-hbKsvEBLEC5fHDkEp7Wwnpd

Watch My Disney Princess to Indian Wedding Series here - Its fun to watch Indian Avatar of Disney Princesses -

https://www.youtube.com/watch?v=lPkRbupcUB0&list=PLswt2K44s-haUOABjzzUOG2jwUh_Fpr96

Watch My Monotone Makeup Looks Here -

https://www.youtube.com/watch?v=WrpPx-_F1Yw&list=PLswt2K44s-hZOfXt-sSQlVe7C_vBOjsWQ

Love Affordable Makeup - Checkout What's new in Affordable -

https://www.youtube.com/watch?v=lowjaZ9kZcs&list=PLswt2K44s-hZcQ-tZUr7GzH0ymkV18U8o

Here is my Get UNREADY With Me -

https://www.youtube.com/watch?v=aLtDX9l8ovo&list=PLswt2K44s-hbLjRz8rtj8FTC-3tZ55yzY

-----------------------------------------------------------------------------------------------------------------------------------

Follow me on all my social media's below:

email :team.nidhivlogs@gmail.com

Facebook: https://www.facebook.com/prettysimplenk/

Twitter : https://twitter.com/nidhikatiyar167

Instagram - https://www.instagram.com/nidhi.167/

Shop affordable Makeup here -

https://www.cuffsnlashes.com

------------------------------------------------------------------------------------------------------------------------------

Shop affordable Makeup here -

https://www.cuffs

Beauty Tips video | 2426 views

মানুহৰ জীৱনৰ ধৰ্ম আৰু কৰ্ম কিহৰ দ্বাৰা পৰিচালিত হয়?

Vlogs video | 2435 views

ভগৱান শ্ৰীকৃষ্ণৰ জীৱন দৰ্শনৰ পৰা আমি কি কি কথা শিকা উচিত?

Vlogs video | 2478 views

চুতীয়া শব্দৰ উৎপত্তি আৰু চুতীয়া সকলৰ ইতিহাস

Vlogs video | 2221 views

Neel Akash live music show 2024 Rongali Bihu || Asin Ayang mane ki? ||

Vlogs video | 2461 views